NFT has become accessible for everyone

Easy to use

Owners split NFTs into shards, and purchasers

subscribe shards for fractional ownership.

Easy to earn

Shard holders effortlessly earn mining rewards by

providing liquidity to the shards in any AMM-enabled

DEX.

Inclusive, secure, and transparent

All the shard owners enjoy an NTF price appreciation

and receive dividends.

They also jointly govern the NFT through a DAO.

$SHD: A token for transparent governance

Issuance

30,000,000

Prepared for

Liquidity Mining, Marketing & Airdrop, Developer

DAO and Investors

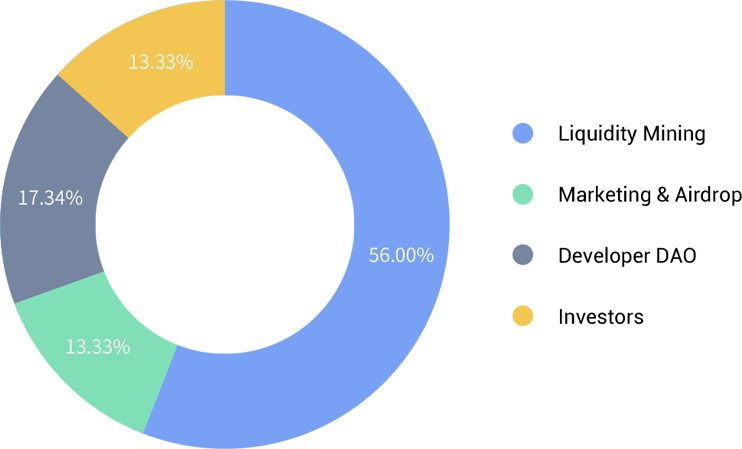

Token Distribution:

As ShardingDAO's governance token, $SHD will be

distributed as below:

Liquidity Mining (56%): distributed to the public through liquidity

mining.

Marketing & Airdrop (13.33%): reserved for Marketing and Airdrop to incentivize

users.

Investors (13.33%): reserved for future investors.

Developer DAO (17.34%): reserved for developers, released along with

protocol liquidity mining.

FAQ

What is a shard?

A shard is an ERC20 token that represents fractional

ownership of an NFT asset. Shard owners can enjoy

the asset's price appreciation and collect

dividends.

What NFTs can be used to create shards?

Any ERC-721 or ERC-1155 NFT can be used to create

shards.

How does the fragmentation work?

Any NFT owner can submit an NFT onto the ShardingDAO

protocol, and the Protocol will fragment the NFT

into shards. After the NFT is fragmented, there will

be a Subscription Period while the original NFT

owner sets a Minimum Subscription Amount. During

this period, intended subscribers stake stable coins

or any other tokens to subscribe for shards. At the

end of the Subscription Period, the fragmentation

becomes complete as long as the final subscription

amount exceeds the Minimum Subscription Amount. And

then, 90% of the shards will be distributed to the

subscribers on a pro-rata basis, while the original

owner and the Protocol will each retain 5% of the

total shards issued.

What do you do with shards?

A shard owner can directly trade shards in

ShardingDAO's marketplace or hold them for dividends

and price appreciation if applicable. Also, a shard

owner can choose to add liquidity to any AMM-enabled

DEX to obtain liquidity provider tokens and then

pledge these LP tokens in ShardingDAO Farms to

receive $SHD liquidity mining rewards.